By Rick Zivi on 10/19/2023

Economy Issues

Here are just a few negative items affecting the economy:

- Over the last 18 months, the Fed has raised the Fed Funds Rate from 0.25% to 5.25%. In public addresses, they have promised to keep rates “higher for longer”.

- The 3 month treasury bill is yielding 5.5%. It has not been this high in 23 years. The 10 year treasury note at 4.98% has not been this high since April of 2007. The increased rates have pushed 30 year mortgage rates above 8% and have severely crippled the housing industry.

- The higher yields caused a mini-banking crisis in the spring which caused virtually all banks to tighten their lending standards and make fewer loans.

- West Texas Intermediate (WTI) crude oil is over $87 per barrel. This is almost 50% higher than the last 10 years’ average price.

- Strikes at UPS, Kaiser, and the auto companies are threatening to derail supply chains and put the country into a wage price spiral.

- Student loan borrowers have to make loan payments again after three years of not paying.

- Delinquency rates for credit cards and car loan are rising rapidly.

What is the result of all this bad news? A relatively strong economy with GDP growth over 2% and an unemployment rate of 3.8% which is near 20 year lows. Very Confusing.

The Lag Effect

Maybe the reason the negative economic items above have not yet caused a recession or a stock market downturn is the fact that interest rate increases take time to affect the economy. Opinions vary on the lag time between rate increases and economic damage, but the consensus is 12 to 24 months. It has been 20 months since the first rate increase in this cycle.

Another possibility for the lack of a slowdown is that rate increases are not hurting companies or individuals as much as in the past. After an unprecedented period of low rates, most homeowners and businesses have low-rate mortgages and loans. Since very few loans will be voluntarily refinanced at higher rates, the rate hikes may not be working as intended. Until debt matures and has to be refinanced at higher rates, the economy may continue to expand slowly.

Stocks

Turning to the stock market, for the first three quarters, the Nasdaq 100 (QQQ) is up 35.13% and the S&P 500 is up 13.07%. Happy days are here again – unless you own value stocks, small-cap stocks, or international stocks. The Dow Jones Industrial Average, which is full of value stocks, increased only 2.3% for the first three quarters. Small-cap stocks represented by the Russell 2000 increased 2.54%, and international stocks represented by the EAFE index increased 7.08%.

Looking closer at the gains in the Nasdaq 100 and the S&P 500, the majority of the gains were the result of only seven stocks. These stocks have been nicknamed the Magnificent 7. Here are the stocks and their 2023 returns through 9/30/23:

| Returns through | Weighting | |||

|---|---|---|---|---|

| 9/30/23 | S&P 500 | QQQ | ||

| Apple | 32.32% | 6.94% | 10.93% | |

| Microsoft | 32.51% | 6.45% | 9.67% | |

| Alphabet (Google) | 48.60% | 4.03% | 6.42% | |

| Amazon | 51.33% | 3.17% | 5.35% | |

| NVDIA | 197.74% | 2.94% | 4.45% | |

| Meta (Facebook) | 149.47% | 1.87% | 3.91% | |

| Tesla | 103.13% | 1.80% | 3.15% | |

| 27.20% | 43.88% | |||

Returns published by Morningstar. |

||||

Because both the S&P 500 and QQQ are market weighted indexes, these 7 stocks have an outsized effect on the index returns. If you take the return from these stocks out of the index returns, 2023 return amounts look a lot different:

Year to date return through 9-30-23 without the “Magnificent 7”:

S&P 500 -5.32%

QQQ 4.72%

Maybe it is time to change your investment plan and go “all in” on the large cap growth stocks of the Magnificent 7. Forget diversification, the efficient market theory, and all common sense. One word of caution – those same stocks had a disastrous 2022:

| 2022 Returns | |

|---|---|

| Apple | -26.32% |

| Microsoft | -27.94% |

| Alphabet (Google) | -38.67% |

| Amazon | -49.62% |

| NVDIA | -50.26% |

| Meta (Facebook) | -64.22% |

| Tesla | -65.03% |

Returns published by Morningstar. |

|

Gloom and Doom or Rainbows and Unicorns?

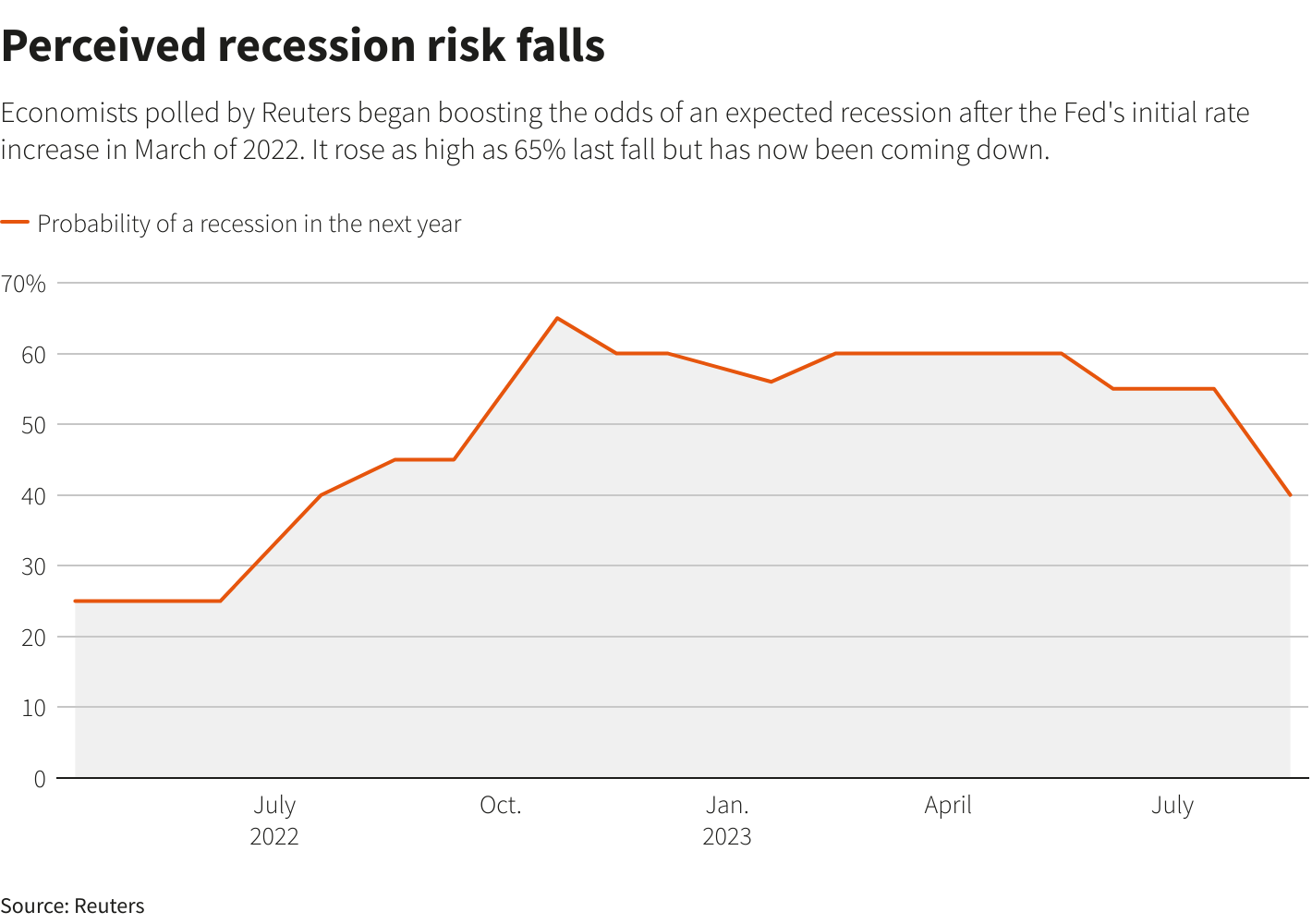

It seems reasonable that the higher interest rates noted above will eventually harm the economy and at best cause a downturn, and at worst cause a recession. I have held that view for most of the past year and have been wrong so far. Below are the results of a poll of economists by Reuters regarding their thoughts on a future recession. You can see that fewer economists are now predicting a recession.

https://www.reuters.com/markets/us/with-gallic-shrug-fed-bids-adieu-recession-that-wasnt-2023-08-16/

In the short to medium term, the economy and the stock market may be in for some volatility. [Volatility is a technical term that means losses.] Using the Doom and Gloom – Rainbows and Unicorns Index (DGRU, patent pending) where a score of 0 is maximum gloom and a score of 10 is constant rainbows, I would give the next year a score of 4.

In the long term, my DGRU score is a 9. Almost all investors should focus on the long term. In the past 30 years, we have had several recessions, a terrorist attack, a dot.com bust, and the great financial crisis. The S&P 500 has had several heart attack moments and losses of over 50% twice. Yet over that 30 year period (per Portfolio Visualizer), the S&P 500 annualized return is 9.72%. $10,000 invested in the SPY ETF on 1/1/94 would now be worth $157,775.

My advice is to ignore the news as much as you can and focus on the long term. If you would like to send me your DGRU score for the next year and the long-term, I will report back on the average results.

Disclosures

The opinions expressed are those of NBZ Investment Advisors, LLC (“NBZ”). The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. This is not a recommendation to buy or sell a particular security. Forward looking statements cannot be guaranteed.

The information presented herein has been obtained from sources believed to be reliable, but NBZ does not warrant its completeness or accuracy. Figures, opinions and estimates reflect NBZ’s judgment on the date hereof and are subject to change at any time without notice. Projections are not guaranteed and may vary significantly. Past performance is not indicative of future results.

The S&P 500 Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Nasdaq 100 is a stock market index made up of 101 equity securities issued by 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It is a modified capitalization-weighted index.

The Dow Jones Industrial Average, Dow Jones, or simply the Dow, is a stock market index of 30 prominent companies listed on stock exchanges in the United States. The DJIA is one of the oldest and most commonly followed equity indexes.

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. It was started by the Frank Russell Company in 1984. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

The volatility (beta) of an account may be greater or less than its respective benchmark. It is not possible to invest directly in an index.

NBZ is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about NBZ’s investment advisory services can be found in its Form ADV Part 2, which is available upon request. NBZ-23-04