Is a Recession Coming?

Safe Places to Stash Cash…

A Word About Schwab…

Soft Landing or Recession?

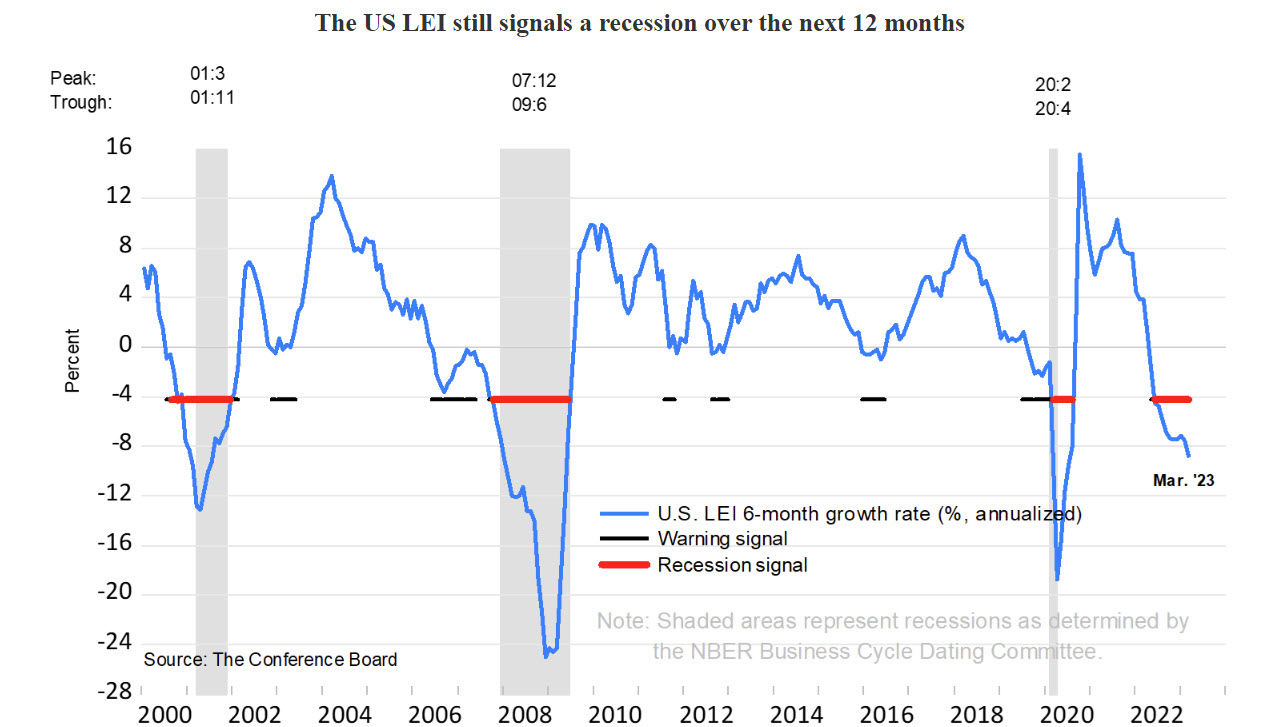

There are many economic indicators that show weakness in the economy, but the Conference Board’s Leading Economic Indicators (LEI) brings everything together to give a complete picture of where the economy is heading. Here is a description of the LEI from the Conference Board’s:

“The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. Shaded areas denote recession periods or economic contractions. The dates above the shaded areas show the chronology of peaks and troughs in the business cycle.”

https://www.conference-board.org/topics/us-leading-indicators

In the chart above, the LEI 6 month growth rate (blue line), has fallen below the predictive recession level. It is likely that the economy will have at least a slowdown, if not an outright recession, within the next 12 months. Does that mean the stock market will decline sharply? Not necessarily – within weeks of the LEI declining below the recession level in 2001, the S&P 500 declined by 19%. Likewise, in 2007, when the LEI fell below the recession level, the S&P 500 declined by 16%. The most recent fall below the recession level, in November 2022, resulted in a 1.76% increase in the S&P 500 (through 4/26/23). It would seem that “this time is different”.

While I do not expect a recession as severe as 2008, or a downturn in the stock market as drastic as 2001-2002 and 2008-2009, I would urge caution for the next several months. We are holding more cash than normal in most client accounts as a precaution.

There is an Alternative

For years, a four letter acronym controlled most investment decisions – “TINA”. This stands for “there is no alternative”, and it means there is no alternative to stocks. Money market accounts and funds paid practically nothing. Bonds and US treasuries paid very little. The Fed caused the low rate environment by holding the Fed Funds Rate near -0- for years. So, investors were “forced” to buy risk assets (stocks, commodities and real estate) to get an “adequate” anticipated return.

Thanks to the Fed’s raising rates over the past year, there are now investment alternatives to stocks. Below are some alternatives that generally have much less risk of loss than stocks:

- Money Market Funds investing in US government bonds are paying from 4.25% to 4.50%.

- Certificate of Deposit (CDs) are paying 5.11% for a 6 month term and 5.10% for a 12 month term.

- US Treasury Bills and Notes pay rates that vary from 5.1% for a 3 month T-Bill to 4.8% for a 1 year treasury note.

The money market funds are more liquid than CDs or Treasuries. If you have cash and would like to earn more interest, we are happy to invest in a money market, CD or treasury for you with no management fee.

Should you be Worried About Schwab?

The Charles Schwab Corporation has two subsidiaries that are separate companies – Charles Schwab & Co, Inc (the brokerage firm) and Charles Schwab Bank. When you open an account at Schwab, most of the time you are dealing with the brokerage firm. Schwab, the brokerage firm, must keep your assets separate from their own. When you invest in a mutual fund or stock, you actually own that investment, not Schwab. So, in the very unlikely event Schwab were to fail, your investments are still protected because they are in your name.

Charles Schwab Bank (per the NY Times) would rank as the nations 10th largest bank. While it had $367 billion in deposits at the end of 2022, it also had $28 billion in unrealized bond losses. These bond losses, which many banks have, spooked the stock market and led to a decline in the value of Schwab stock. Silicon Valley Bank (SVB), also had large bond losses, but over 90% of its deposits were not insured by the FDIC. When uninsured corporate customers tried to get the money out of the bank, the bonds with losses had to be sold. By contrast, Schwab’s deposit base is mostly retail customers and more than 80% of that money is under the FDIC limit. Schwab has many more sources of cash than SVB.

Michael Wong, the director of equity research at Morningstar, says “Schwab shouldn’t ever have to change those unrealized losses into realized losses by selling the securities, because it has so much access to cash”.

To summarize, Schwab brokerage is not part of the “banking crisis”, and Schwab Bank has most of its customer deposits insured by the FDIC and access to plenty of cash to avoid any runs on the bank.

References

NY Times Article – Why Schwab, a Financial Giant, Got Hurt in the Regional Banks Panic

https://www.nytimes.com/2023/03/31/your-money/schwab-bank-failure-panic.html

The Conference Board – US Leading Indicators

https://www.conference-board.org/topics/us-leading-indicators

Disclosures

The opinions expressed are those of NBZ Investment Advisors, LLC (“NBZ”). The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed.

The information presented herein has been obtained from sources believed to be reliable, but NBZ does not warrant its completeness or accuracy. Figures, opinions and estimates reflect NBZ’s judgment on the date hereof and are subject to change at any time without notice. Projections are not guaranteed and may vary significantly.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

NBZ is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about NBZ’s investment advisory services can be found in its Form ADV Part 2, which is available at nbzinvest.com or by calling (865) 584-1184. NBZ-23-03.