Last week we saw one of the worst two day declines in the history of the stock market. What stands out about this two day downturn versus others in history is that this decline was policy driven. There was no global pandemic (2020) or dot.com bubble bursting (2000) or banking crisis (2008). OPEC did not double the price of oil (1973).

The U.S. put in place a series of tariffs that although expected by the market, exceeded the worst case of most market participants. While the goals of this strategy may be laudable (or not) and the results in the future might be great for our country and the world (or not), we cannot know those answers now. On the other hand, we can say with certainty that the scope of the tariffs were larger than anyone had planned for, and the rollout was chaotic at best. Warren Buffet has a quote attributed to him “In the short run the market is a voting machine, but in the long run it is a weighing machine”. The market voted Thursday and Friday and said “NO!”.

Many times the market has a short-term correction or pullback. This time, though, commentators are predicting dire long-term consequences including a worldwide recession (maybe depression), the end of the current world order, and the virtual end of international trade. They have done a great job of scaring everyone and creating an environment of panic. Obviously no one knows if the worst predictions will come true, but aside from a few countries who have retaliated, most countries seem to want to negotiate for lower tariffs.

We build portfolios to hold up in these kinds of tough environments. For most investors, we allocate investments between fixed income (mainly bonds and bond funds), tactical funds and ETFs, and equity funds and ETFs. With the S&P 500 down 10.5% in two days, the equity allocation declined with the market. Fixed income actually increased, and the tactical allocation held up much better than the S&P 500.

Patience is a hard commodity to come by with talk of tariffs and trade wars in the air, but that is what is needed now. Always in the past, markets have rebounded from downturns. Sometimes it takes a few months, other times several years. Sticking with your allocation now is the best plan of action. If you sell equities now, invariably you will miss out on the strong rebound.

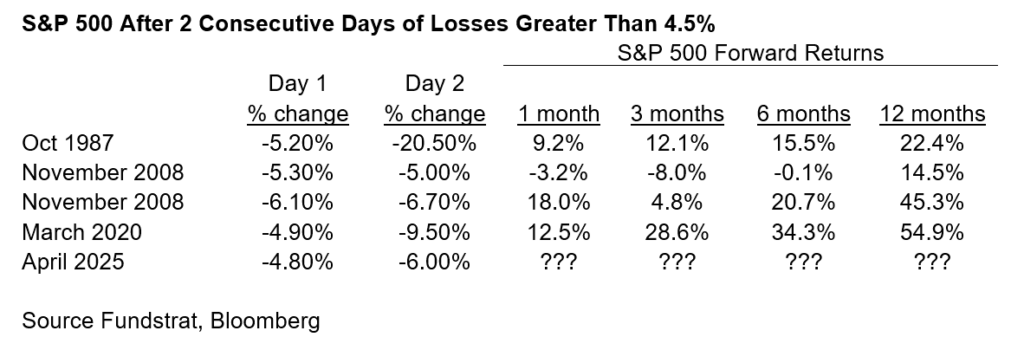

Since 1950, there have been four other instances when the S&P 500 had two consecutive days of losses of more than 4.5%. Here is what happened in those instances after the two loss days:

As we all know, past performance is no guarantee of future success. However, it is good to know that two really bad days in the market can turn around in time. Feel free to call and talk to Brad, Rick or Sam anytime. We are happy to discuss your situation, the markets, retirement, taxes and more with you.

Disclosures

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization. The Bloomberg U.S. Aggregate Bond Index is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. The Index is frequently used as a stand-in for measuring the performance of the U.S. bond market. In addition to investment grade corporate debt, the Index tracks government debt, mortgage-backed securities (MBS) and asset-backed securities (ABS) to simulate the universe of investable bonds that meet certain criteria. In order to be included in the Index, bonds must be of investment grade or higher, have an outstanding par value of at least $100 million and have at least one year until maturity. The volatility (beta) of an account may be greater or less than its respective benchmark. It is not possible to invest directly in an index.

NBZ is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about NBZ’s investment advisory services can be found in its Form ADV Part 2, which is available at nbzinvest.com or by calling (865) 584-1184. NBZ-25-02.

The opinions expressed herein are those of NBZ. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward-looking statements cannot be guaranteed.