Investment results for the first quarter of 2022 were a disappointment, to say the least. The major averages declined substantially, but not disastrously:

S&P 500 (large-cap) – 4.60%

Russell 2000 (small-cap) – 5.13%

EAFE (developed international) – 5.91%

Two types of investments had returns that seem pretty terrible, though. Almost everyone owns a good portion of both of these asset classes. The first investment type that had disturbing returns was growth stocks. Growth stocks have dramatically outperformed value stocks for years, but in the first quarter, growth stocks got creamed:

Russell 1000 Growth (large-cap) – 9.04%

Russell Mid-Cap Growth – 12.58%

Russell Small-Cap Growth – 12.63%

Here are the returns for the three largest growth funds for the first quarter:

American Growth Fund of America – 10.77%

Fidelity Contrafund – 9.80%

T Rowe Price Blue Chip Growth – 12.38%

Valuations of growth stocks contracted due to the rapid increase in interest rates (see below). If the pace of interest rate increases moderates, growth stocks should recover over the next several quarters.

The second type of investment that had awful returns was bonds. Yes, the same bonds that you hold for safety and to outperform when the stock market is weak. Almost all bond categories declined, not just junk bonds or emerging market bonds. How bad was it? Here are three bond indexes and their performances for the first quarter:

Bloomberg US Aggregate Bond (AGG) – 5.93%

Bloomberg US Intermediate Agg Bond – 4.69%

Bloomberg Municipal Bond – 6.23%

Here are the returns for the three largest bond funds for the first quarter:

Vanguard Total Bond Market Index – 6.01%

Vanguard Total International Bond Index – 5.09%

iShares Core US Aggregate Bond – 5.86%

Why Did Bonds Lose So Much in First Quarter 2022?

A 5% to 6% loss in a quarter for bonds is not unprecedented. In the last 40 years, quarterly losses of that magnitude only occurred twice – in 1980 when the Fed Funds rate was see-sawing between 8.5% and 20%. Most losses in the main bond index (AGG) are a result of a Fed rate raising cycle. The Fed started raising rates last month and is also trying to erase the effects of its Quantitative Easing (QE) by reversing course to Quantitative Tightening (QT). During QE, the Fed bought bonds with money it created. This was for the purpose of providing liquidity to the system. One side effect of QE was inflated asset prices (stocks). QT is the process of selling those bonds to the public and taking cash out of the system. The purpose of both the rate hikes and the QT is to slow the economy and reduce inflation.

The “market” anticipates the Fed’s rate increases and attempts to get ahead of the cycle by bidding up the interest rates on government and corporate bonds. When interest rates rise, the value of bonds go down. In prior fed rate raising cycles, the increase in bond rates was gradual. For this cycle, though, the increase in rates was very fast. In seven months, the rate of the two-year treasury note increased from 0.30% to 2.67%. Below is a table of the prior three Fed tightening cycles that compares the magnitude of the Fed rate increases with the two-year treasury note rate increases:

How Might Bonds Perform Going Forward?

It seems that the combination of Fed rate hikes and QT has caused the market to panic. Rates on government and corporate bonds have increased too much, too fast, which has caused the value of bonds to crater. In prior tightening cycles, losses in the AGG normally covered several quarters in more modest amounts per quarter. Below is a comparison of prior cycles that looks at the AGG returns from the start to the end of rate increases, and the returns for the AGG for the four quarters after the cycle ended. This quarter’s AGG loss was an anomaly compared to prior tightening cycles.

I think the bulk of bond losses from the current Fed tightening cycle have already occurred. I do not expect bonds to scream higher in the next few weeks, but I would expect losses to be lower by year-end. Overall, returns during the past five tightening cycles were positive (based on the AGG returns).

A Recession is Not Inevitable

The tools that the Fed has at their disposal to fight inflation are raising interest rates and reducing the money supply (QT). Both of these tools are blunt kind of instruments whose purpose is to slow economic activity. The Fed hopes to achieve a “soft landing” where the economy slows, inflation cools, but a recession is avoided. Many commentators believe we will have a hard landing and a recession will occur in late 2022 or 2023. With mortgage rates already at 5%, and US Treasury bond rates having risen dramatically (above), it is easy to see how the Fed could push us into a recession. Here are some reasons why a recession might be avoided:

- Inflation could decline as supply chain issues resolve themselves and energy prices stabilize with increased production.

- Consumer demand for houses, travel, and entertainment remain high. Increased mortgage rates might dampen demand, but we have a serious housing shortage.

- Earnings of companies appear to be maintaining their strength. The balance sheets of companies and individuals are strong.

- Employment remains very strong and layoffs seem unlikely.

- Covid does not spike badly causing new shutdowns.

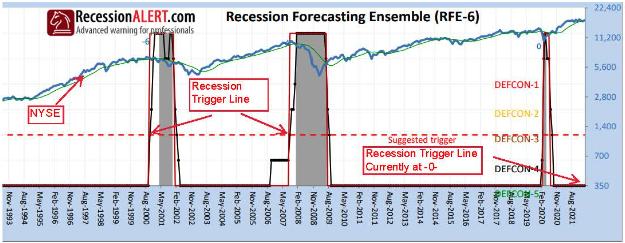

I subscribe to a service called Recession Alert. It provides many indicators and charts to map the economy and warn about impending recessions. Below is a chart that shows the last three recessions (in gray), and the indicator that warned of the 2001 and 2008 recession months before the recession officially began. The indicator did not warn about the 2020 pandemic caused recession in time to do anything. The main thing to note on the chart is that currently, the recession risk indicator is at -0-. So, for now, no recession is on the horizon. I will keep watch on the reports from this service and encourage anyone interested to subscribe at recessionalert.com.

Is It Time To Sell Your Stocks and Funds?

Given the rise in interest rates, the Fed’s actions to come, the uncertainty of the Ukraine war outcome, the possible political division in the midterm elections, out of control inflation, and Covid always in the background, maybe now is a great time to sell stocks and equity funds and to just wait for happy days to be here again. Seriously, the near-term future seems pretty bad. I actually think holding more cash than normal is a prudent response, and we are doing that in most portfolios. For the bulk of your equites, though, you have to look longer-term. How long? I think 5 – 10 years. Most of the awful news above will be long gone by then and there is a good chance that stocks are higher than today. There is an organization called the American Association of Individual Investors (AAII) that is made up of mainly small, retail investors. They run a survey every week where members vote on whether they are bulls, bears, or neutral. Their survey, which has been in existence since 1987, is a great contrarian indicator. When the percent of bullish members falls below 20%, the S&P 500 is almost always positive a year out from the score. In the past 34 years, there have been 31 instances when the bullish percentage was below 20%. In 30 of those cases, the market increased a year later. For the past two weeks, the percent of AAII bullish members has been below 20%. Only six times before has the bullish percent been below 20% for two weeks in a row. In each of those prior six instances, the S&P 500 was higher a year later. So, should you mortgage your house and put everything in the market right now to bet on a sure thing? No. Hold the bulk of your equites, hold a little cash, and try not to watch the news.

Disclosures

The information herein has been obtained from sources believed to be reliable, but NBZ does not warrant its completeness or accuracy. Prices, opinions and estimates reflect NBZ’s judgment on the date hereof and are subject to change at any time without notice. Any statements nonfactual in nature constitute current opinions, which are subject to change. Projections are not guaranteed and may vary significantly. Any investment strategies presented may not be appropriate for every investor and individual clients should review with their financial advisors the terms and conditions and risk involved with specific products or services. As with all investments, past performance does not indicate future results. Investing involves risk including the potential loss of principal.

NBZ is a registered investment adviser. Registration does not imply a certain level of skill or training. More information about NBZ, including its advisory services and fee schedule, can be found in its Form ADV Part 2 which is available at nbzinvest.com or by calling 865-584-1184. NBZ-22-04