What the Experts Said

Remember what was supposed to happen last year? 2022 was going to be the first year the world opened back from the pandemic. Inflation was said to be transitory, earnings would increase, and the market environment looked good:

- A Reuters poll of strategists in December 2021 predicted a 7.5% gain in the S&P 500 driven by earnings and economic growth. [The actual return for the S&P 500 was a loss of 18%.]

- The Federal Reserve’s December 2021 report predicted PCE inflation of 2.6% for 2022. It also predicted the Fed Funds rate at year-end 2022 to be 0.90% and that GDP growth in 2023 would be 2.2%. [The actual PCE inflation rate for 2022 was 5.5%, the Fed Funds rate is now 4.5%, and the December 2022 report of the Fed predicts GDP growth in 2023 of 0.50%.]

For 2023, the experts’ consensus is that the S&P 500 will increase 7% by year-end, but it will probably suffer double digit losses sometime during the year. Most experts predict a recession sometime during the year.

Data above from Reuters.com and CNBC.com

What is Happening Now

My New Year’s Resolution is to stop listening to experts. Here is what we know in early January 2023:

- The year over year CPI inflation rate peaked at 9.1% in June.

- The Fed raised the Fed Funds rate from 0.25% to 4.5%, which was a 1,700% increase. Never before has the Fed raised rates by that high a percentage in a single year.

- The Fed has signaled their intention to raise rates to 5.25% during 2023, which would be a 16.7% increase from the current level.

- Employment remains strong. Jobs have continued to increase and new unemployment claims have not increased.

- Longer-term interest rates, such as the yield on the 10 year treasury bond, are less than short-term rates. This is known as an inverted yield curve and many times signals a recession.

- Many economic indicators are negative:

- The manufacturing and service surveys by the Institute of Supply Managers (ISM) are in contraction mode as of the December survey results.

- The Conference Board’s Leading Economic Indicators, which portray the strength of the economy, peaked in February of 2022, and have declined each month since then.

Contrary to what both optimists and doomsayers are saying, we have a very mixed economic picture. Overall economic indicators are negative, but employment and retail sales remain positive. Because the Fed interest rate increases take some time to impact companies and the economy, we do not know their ultimate effect yet.

What to Expect in 2023

As a certified non-expert, I feel qualified to give some possible outcomes for 2023 regrading the economy, stocks and bonds. I think the key factor for 2023 results is inflation.

- Worst Case – If inflation remains elevated, or increases, the Fed will continue to raise interest rates, regardless of the effect to the economy. As rates increase, the economy will weaken appreciably. We will probably have a severe recession. Earnings of companies will decrease and the stock market will have a sharp downturn. While the bond market will not have as bad a result as 2022 (the aggregate bond index had its worst year since its inception), bonds will not have huge gains.

- Pretty Bad Case – If inflation continues to decrease slowly, the Fed will raise rates modestly, but keep them elevated. The economy will continue to weaken, and we will probably have a mild recession. Company earnings will decrease and the stock market will have a downturn. Since the market typically overreacts to economic forces, the downturn could be significant. Once it is clear that we are not going to repeat the carnage of 2008, the stock market could begin to recover. In this scenario, bonds have a solid up year.

- Not What Anyone is Expecting Case – What if inflations decreases quickly? Maybe by mid-year the CPI is below 4% and continuing to decline. The Fed will still raise rates modestly, and the economy will slow, and possibly go into a shallow recession. Company earnings will not decrease significantly. While the stock market might be volatile, it will not have a major downturn. When the economy starts coming back, or the Fed begins reducing rates, the market could come roaring back. Bonds will soar as rates decline.

Is Inflation Coming Down?

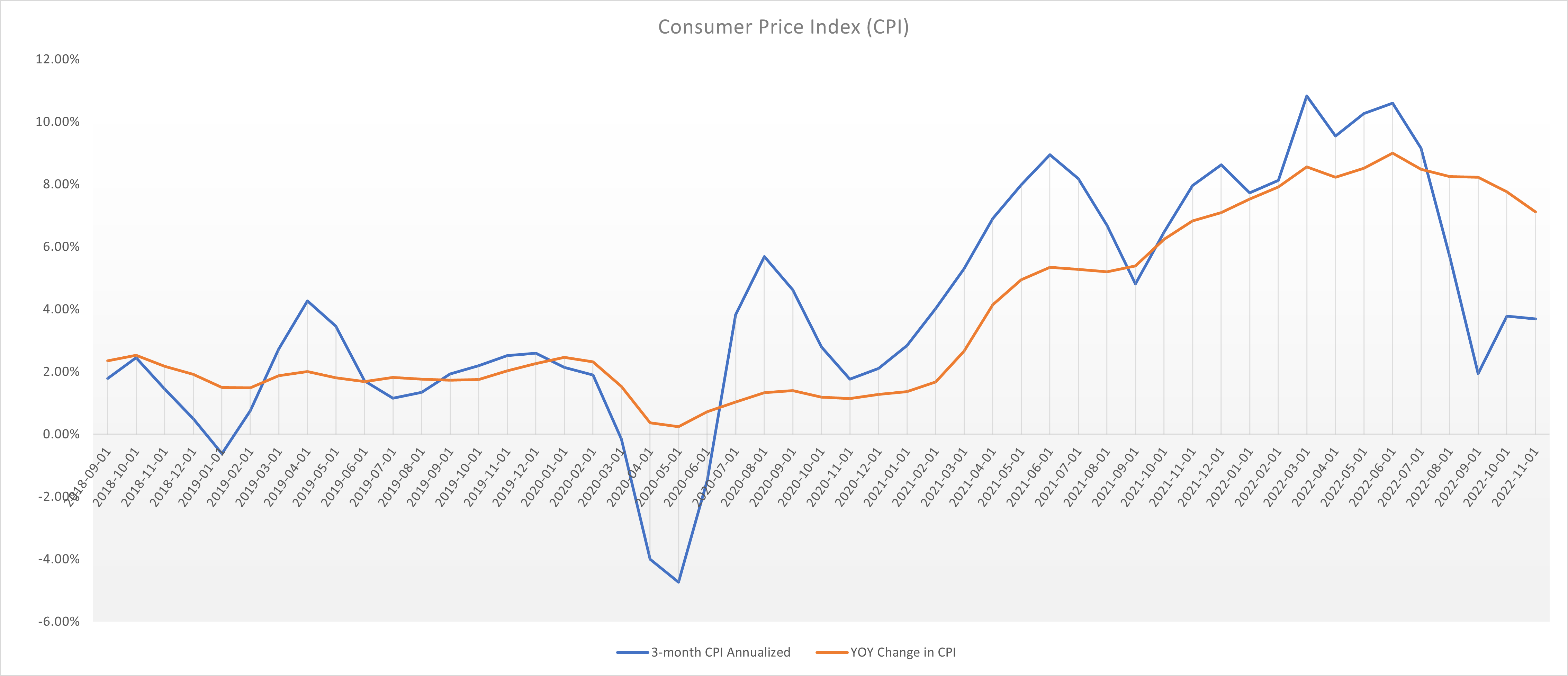

The headlines always blare out the year over year inflation change. That number does not tell us where inflation is headed currently. In the chart below, with data from the Federal Reserve, I have plotted the year over year inflation data and also the three month (annualized) inflation data. Note that in 2020 and 2021 the three month inflation showed a drastic increase. It foreshadowed the large increase in the annual inflation data. Now note the dramatic decline that the three month inflation data has recently displayed. Will the annual inflation data follow suit?

The chart was generated by NBZ Investment Advisors, LLC using CPI data published by Federal Reserve Economic Data [FRED®].

Disclosures

The opinions expressed are those of NBZ Investment Advisors, LLC (“NBZ”). The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. Forward looking statements cannot be guaranteed.

The information presented herein has been obtained from sources believed to be reliable, but NBZ does not warrant its completeness or accuracy. Figures, opinions and estimates reflect NBZ’s judgment on the date hereof and are subject to change at any time without notice. Projections are not guaranteed and may vary significantly.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

NBZ is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about NBZ’s investment advisory services can be found in its Form ADV Part 2, which is available at nbzinvest.com or by calling (865) 584-1184. NBZ-23-01.