Both stocks (represented by the S&P 500) and bonds (represented by the Bloomberg US Aggregate Bond Index [AGG]) have had horrendous returns so far this year. At the end of last week, the year-to-date losses for the S&P 500 and the AGG were (22.33%) and (11.48%), respectively. The reasons for the declines are:

- Inflation

- The Federal Reserve’s reaction to inflation

There are many causes for the current inflation we are experiencing – supply chain issues, the war in Ukraine, a tight labor market, etc. The Fed was late to react to inflation and now is attempting to tamp down inflation by raising interest rates and reducing the money supply. You might ask how increased interest rates will solve the supply chain issue or stop the war in Ukraine. Easy answer – it will not. The only thing increased interest rates can do is lower economic activity by raising borrowing costs for companies and individuals. Less economic activity equals fewer jobs and less demand for goods and services. Once people start losing jobs, wages go down. Less demand for goods and services equals lower costs. Pretty soon, inflation is wiped out.

Unfortunately, pretty soon might mean months or years. The longer it takes to reduce demand, the higher the risk that the economy will contract and go into a recession. On June 22, Bill Dudley, the former president of the New York Fed, stated “If you’re still holding out hope that the Federal Reserve will be able to engineer a soft landing in the US economy, abandon it. A recession is inevitable within the next 12 to 18 months.”

Impact of Inflation, Recession on Stocks

Both inflation and a recession can reduce companies’ earnings and cause stock prices to decline. In addition, increased interest rates reduce the value of future earnings which also cause stock prices to decline. Stocks prices, in theory are a reflection of the future earnings discounted back to today’s dollars using a discount / interest rate. The higher the discount rate, the lower the value of the future earnings. This is kind of the reverse of compounding. Here is an example:

A stock earns $10 per share for the next 10 years. In total, its earnings will be $100. If we discount those earnings back to current dollars using a 2% discount rate, the value of the earnings is $90. If the discount rate rises to 5%, the value of the earnings is only $77. The increase in the discount rate caused the stock value to decline by 14% even though earnings did not change.

This sounds pretty grim. Maybe you should sell your stocks before a recession hits and buy them back after the recession is over. Unfortunately, life and investing is not that easy. First, recessions are officially determined by the National Bureau of Economic Research (NBER). Many times, the NBER does not notify the public of a recession until months after one has begun. Second, almost always, the market bottoms and begins to rise long before the recession is officially over. Once again, the NBER might not tell us a recession is over until months after the official end. So, if you try to time the market around the official notice of a recession beginning and ending, you will sell near a low point and buy back in after the rebound.

Below is a chart of the S&P 500 from 1932 to present, which has all the recessions during that 90 year period marked with vertical lines. Note that the market bottomed most of the time before the recession ended.

Chart sourced from https://www.macrotrends.net/2324/sp-500-historical-chart-data

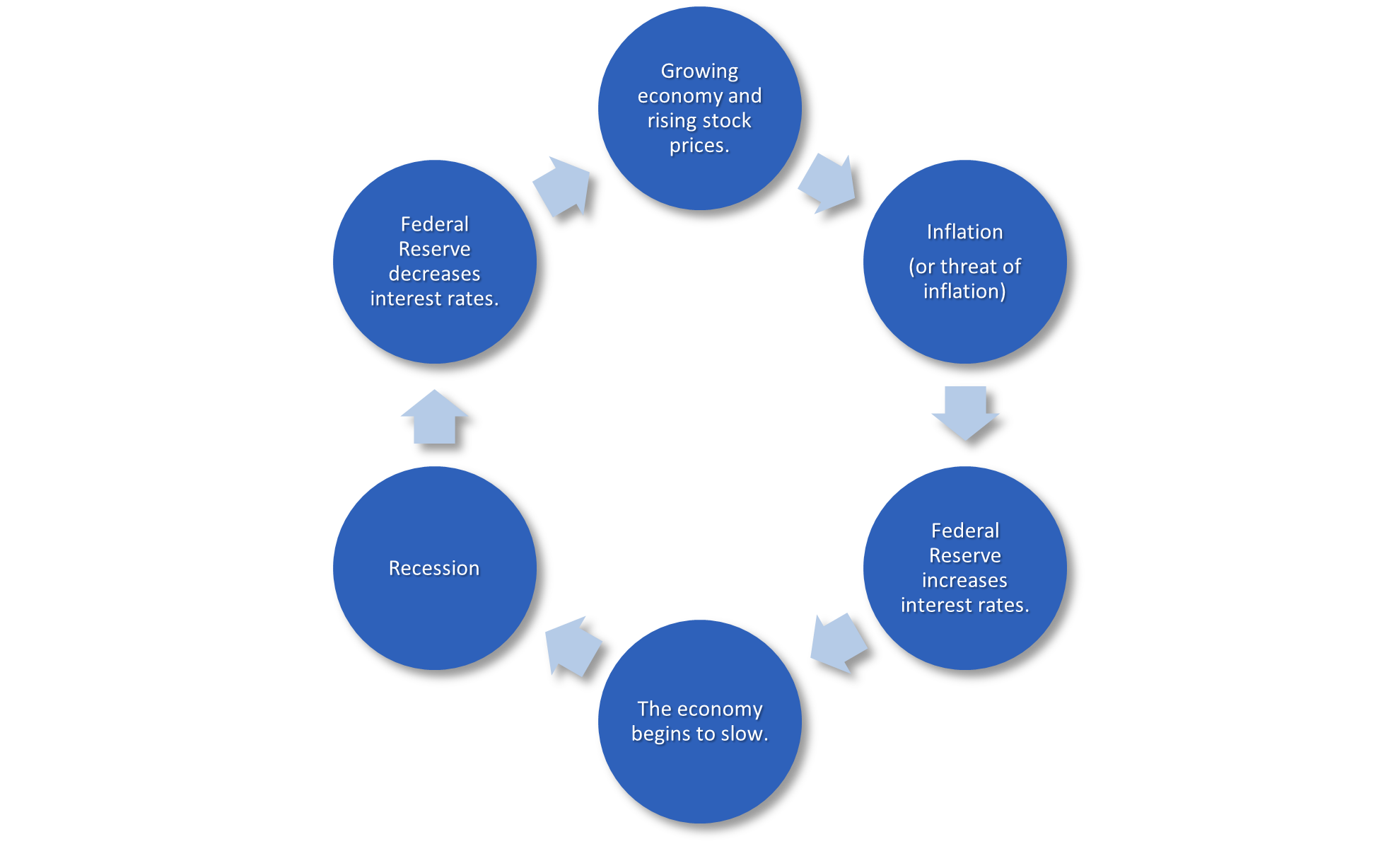

The graphic below depicts the general economic cycle and serves to explain both recessions and recoveries. Rapidly growing economies eventually experience overheating and imbalances. This overheating leads to elevated inflation. The Federal Reserve then deploys monetary policy, raising interest rates and tightening financial conditions, to slow down the economy and bring it back into balance. This “quantitative tightening” (QT) deters economic activity, stock prices fall, and recession often results. The Federal Reserve then goes back to its monetary policy toolkit to cut interest rates and loosen financial conditions. This spurs economic activity resulting in renewed growth and higher stock prices. The cycle then repeats itself. Unfortunately, we do not know the timing of the factors in the cycle beyond the Fed’s rate increases, which have already begun.

Impact of Inflation, Recession on Bonds

Inflation has a very negative effect on bonds, while recessions normally cause bonds to rally in value. Inflation causes the Fed to raise interest rates which reduces the value of a bond. Why is this? Let’s assume you purchase a bond for $1,000 with a 5% fixed interest rate. You will earn $50 per year in interest. What happens to the bond price if interest rates rise to 5.55%?

The interest earned can be stated in a simple equation:

Bond price x interest rate = interest earned.

$1,000 x 5% = $50

Another equation can get you the bond price:

Interest earned / interest rate = bond price.

$50 / 5.55% = $909

If rates increase to 5.55%, the value of the bond goes down to $909. A buyer of your bond who wants the current interest rate of 5.55% would only pay you $909 for the $50 of interest your bond earns ($909 x 5.55% = $50).

Interest rate increases so far in 2022 have reduced the value of bonds. In a recession, the Fed lowers rates to spur economic activity. Lower rates increase the value of bonds. Many times, bonds increase in value long before the Fed reduces rates because of the following factors:

- The market anticipates what the Fed might do based on economic reality and projections. If the economy starts to slow, interest rates might start coming down before the Fed reduces rates.

- While the market value of the bond in our example above decreased, the maturity value stayed at $1,000. When the bond matures, you will get the full $1,000 back. As the bond gets closer to maturity, the value increases regardless of the interest rate.

In bond funds, the factors above apply along with an additional factor. Bond funds hold many bonds and each year some of them mature. When a bond matures and interest rates are rising, the proceeds of the bond are reinvested at the higher rate. As bonds mature and are reinvested, the value of the fund increases as does the interest you earn.

Recovery Time?

Because of the reasons discussed above, we believe bond funds should begin recovering in the next few months. Even though the Fed is not finished raising rates and inflation has not been subdued, the market is looking ahead to a slower economy. The 10 year US government bond is a proxy for the economy and GDP growth for the next several years. It rose from a low of 1.19% last August to a high of 3.49% last week. On 6/22 it was down to 3.15%. Look for its yield to continue to be volatile in the coming months, but with a downward bias resulting in higher bond values.

Stocks could take longer to bounce back and more pain may be in store. At this point we do not know for sure if there will be a recession or how severe it might be. Is this period going to be like 1990 (a shallow recession with a downturn in the market of only 20%) or like 1973 -1974 (a severe recession with a 50% decline in the S&P 500)?

In the short-term, the market is what is called oversold. Think of a rubber band stretched as far as it can go. At some point it can’t take any more stretching and bounces back. Right now the market has declined swiftly and seemingly non-stop for weeks. Many indicators are overstretched and we should see a bounce soon (possibly after more downside, though). In the last three bear markets, 1973-1974, 2001-2003, and 2008, there were seven bear market rallies. They ranged in magnitude from 8% to 26% and four of them were over 18%. Even if we are in bear market with more losses ahead, we should see some interim relief from a rally soon.

Disclosures

The information herein has been obtained from sources believed to be reliable, but NBZ does not warrant its completeness or accuracy. Prices, opinions and estimates reflect NBZ’s judgment on the date hereof and are subject to change at any time without notice. Any statements nonfactual in nature constitute current opinions, which are subject to change. Projections are not guaranteed and may vary significantly. Any investment strategies presented may not be appropriate for every investor and individual clients should review with their financial advisors the terms and conditions and risk involved with specific products or services. As with all investments, past performance does not indicate future results. Investing involves risk including the potential loss of principal.

NBZ is a registered investment adviser. Registration does not imply a certain level of skill or training. More information about NBZ, including its advisory services and fee schedule, can be found in its Form ADV Part 2 which is available at nbzinvest.com or by calling 865-584-1184. NBZ-22-06